Learn how to set up a new payee in Payment Compass.

If you do not have Single Sign-On access, please contact us by email at W-9s for payees of UCSD You will then see a pop-up window where you can type, draw or import an image with. As long as you are a US citizen or US resident alien and a UC San Diego employee, you or your supervisor, may sign and date the W-9.įor additional information, contact us via Services & Support (login required). Next click the Sign link at the top of the form, and choose Add Signature. you are not required to sign the Certification, but you must provide your correct TIN. I went ahead and used Adobe Reader to sign it by drawing with my trackpad. You'll need to print the form out, sign it, and scan it or take a picture of it. The signature authority for W-9s have been delegated to departments. State of Arizona Substitute W-9 & Vendor Authorization Form. If the W-9 provider hasn't given you an explicit way to digitally sign the document, then they probably won't accept anything but your actual signature. For US income tax purposes payees will be asked to provide their citizenship status, legal name, address and SSN when registering via Payment Compass. If you receive a request from a payer for a W-9, for most purposes, submit the standard UCSD form W-9, for FEIN 956006144 (PDF).

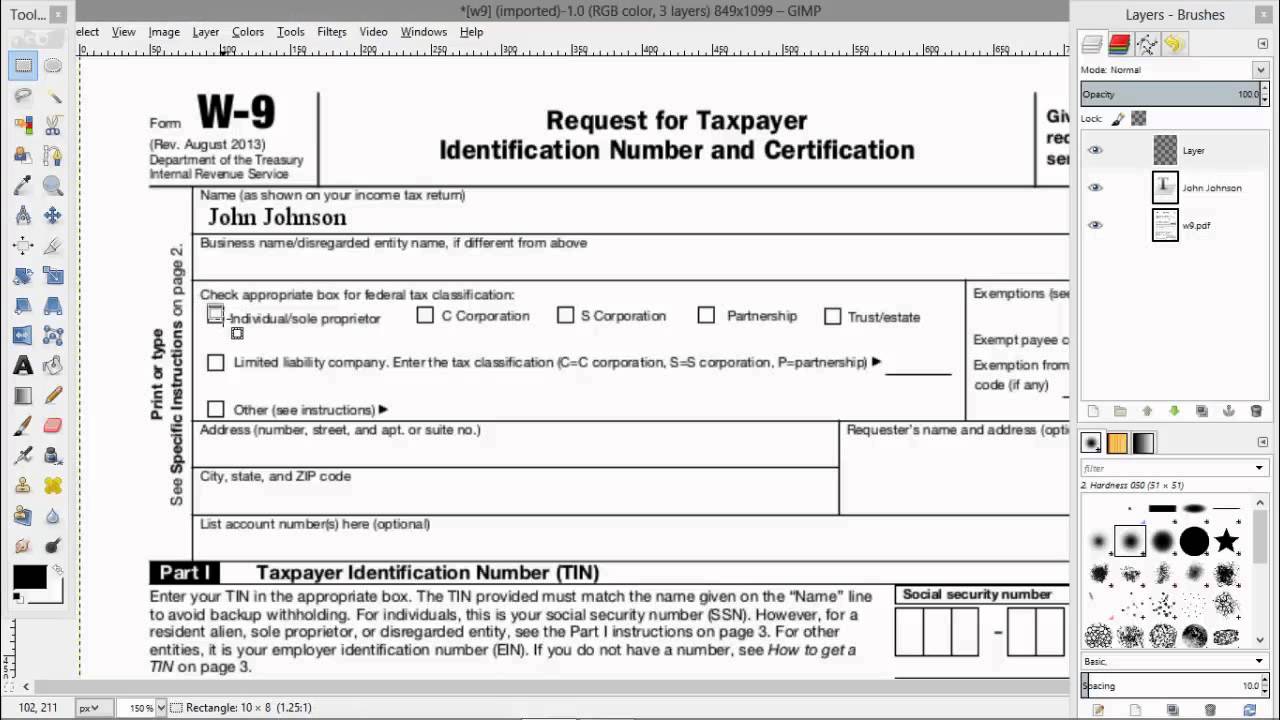

If you are an employee, your employer will offer you the form. Your department might receive a W-9 request from payers so that they can properly report information in connection with miscellaneous payments to the university (for interest, dividends, rents, royalties, etc.), or by donors to enable them to claim tax deductions for gifts, donations, or grants to the university. Make sure the W 9 form you got is the right one. UCSD needs to be concerned with W-9s for both payers and payees. IRS Form W-9, Request for Taxpayer Identification Number and Certification, is used to certify the taxpayer identification number (TIN) or Federal Employer Identification Number (FEIN), type of taxpayer, and tax status. Find out what to do if you receive a request for a W-9 form.

0 kommentar(er)

0 kommentar(er)